Yelp Data Reveals the Top 50 Fastest Growing Brands

Challenger brands lead the way, with CAVA, Scooter’s Coffee and LongHorn Steakhouse topping list

April 10, 2024

As a platform dedicated to helping businesses succeed, we’re excited to release Yelp’s first-ever list of the 50 fastest growing brands to recognize the companies that have successfully executed growth strategies over the last year. From newly public companies to those scaling regionally to industry mainstays broadening their footprint, the brands featured on the list are expanding at a fast rate nationally, by state and geographical region. We ranked businesses based on Yelp data, including net-new location openings, consumer interest and searches, which together highlight how quickly businesses are opening new locations and growing existing ones.

Yelp’s data demonstrates momentum for challenger food, restaurant and retail brands that are quickly becoming the next class of household favorites. Challenger brands—defined as businesses that are not market leaders but aim to compete by disrupting their industry—make up over 70% of the brands on the list.

Challenger brands led major growth in consumer interest on Yelp

Challenger brands lead the nation in growth, with CAVA in top spot

Topping the list is CAVA, the fast casual restaurant that aims to bring Mediterranean traditions and cuisine to the masses. Established in 2010, CAVA’s vision of introducing a new, healthier dining option to a wider audience has enabled it to become one of the fastest growing businesses, as it opened 72 new locations across the U.S. in 2023 alone. According to Yelp data, the brand saw a 54% increase in consumer interest nationwide from 2023 compared to 2022, not to mention claiming the fastest growing brand spot in California, Colorado, Pennsylvania, Georgia and Alabama.

While it’s known for its Mediterranean-inspired bowls, even CAVA’s drinks have caught the attention of Yelp users. Yelp’s review insights revealed that CAVA’s beverages, including pineapple apple mint and blueberry lavender, are what keep customers coming back. Yelp users continually praise these drinks for their taste, quality and customization options.

Explore the full list of the fastest growing brands:

Yelp's 2024 Fastest Growing Brands

The fastest growing brands reflect changing American consumer interests

Food courts are so back

Nostalgia is striking a chord with millennials and Gen Z, and food courts are exploding back on the scene, expanding beyond traditional malls to include neighborhood food halls and outdoor shopping centers. Over 30% of the businesses on the list can be found in traditional malls. Restaurant and food brands that have a high number of locations in malls, like Wetzel’s Pretzels (no. 22), Cinnabon (no. 25), Marble Slab Creamery (no. 32), Panda Express (no. 35) and Charleys (no. 42) are seeing increased velocity as physical retail centers look toward a possible comeback. Wetzel’s Pretzels saw a 67% increase in consumer interest nationwide, while Cinnabon saw a 131% jump in the Midwest specifically. Marble Slab Creamery was the fastest growing brand in Mississippi, with a 423% surge in consumer interest in the state.

Americans are nostalgic for the heartland’s comfort food

The Midwest is home to nine of the top 50 brands, from Culver’s (no. 14), founded in Wisconsin in 1984, to St. Louis-born Panera Bread (no. 17). Brands that are owning their Midwestern roots are catching fire among consumers, like Culver’s, which emphasizes community ties and family values, and Freddy’s Frozen Custard & Steakburgers (no. 7), which sells comfort food that reflects the warmth and familiarity of the region’s cuisine. Culver’s saw fervor for its butter burgers and cheese curds, resulting in a 15% pop in consumer searches, and Freddy’s made major headway into the tri-state area, with a landslide of consumer interest in New Jersey, up 232% from a year ago. Panera’s menu additions and store expansion contributed to a 54% increase in consumer interest nationally.

Brands go ‘feed-first’

Businesses like CAVA, Raising Cane’s (no. 18), Nothing Bundt Cakes (no. 26) and Crumbl Cookies (no. 40) are leaning into their virality by offering unique, camera-ready menu options, like Raising Cane’s cup of sauce, and limited time items, which inspire customers to share their dining experiences on Yelp and other social channels. The viral success these brands saw on social combined with a dedicated following on Yelp led to repeat foot traffic, bringing new customers into their stores and propelling serious business growth. Nothing Bundt Cakes saw national consumer searches climb 18%, while Crumbl Cookies grew the fastest in Virginia, with a 161% increase in consumer interest. Looking regionally, Raising Cane’s leveraged its virality to help it expand, with a 12% increase in net new locations, and charted as the fastest growing brand in Florida, with a 1,300% increase in consumer interest in the state.

Chicken chains hatch in new regions

It’s no secret that Americans love fried chicken, and many of these beloved comfort food spots are among the fastest growing brands. Businesses like Popeyes Louisiana Kitchen (no. 6), Bojangles (no. 13), Krispy Krunchy Chicken (no. 41) and Raising Cane’s represent the exploding category. “Chicken wars” top contender Popeyes led the pack, with a nationwide consumer interest increase of 34%. It was also the third fastest growing brand in the Northeast, where it saw a 52% bump in consumer interest. Bojangles was the second fastest growing brand in the Midwest, with a 26% increase in net new locations, while Krispy Krunchy Chicken captured the number three spot on the fastest growing brands in the West, with a 31% lift in consumer interest.

‘Little Treats’ mean big business

The Gen Z “little treat” trend—a small purchase or snack for an instant serotonin boost—is helping to drive many businesses forward. Brands like HomeGoods (no. 48), Dutch Bros (no. 36), Caribou Coffee (no. 31), Nordstrom (no. 16), Insomnia Cookies (no. 49) and Nothing Bundt Cakes, among others, are building a business around treating yourself. Dutch Bros, for example, brought its specialized coffee drinks nationwide, with a 25% bump in consumer interest nationally, while HomeGoods saw a 449% spike in consumer interest in New Hampshire. Insomnia Cookies is bringing late night sweets nationwide, with a 13% increase in net new locations in 2023.

Coffee house challengers like Scooter’s Coffee and Dutch Bros are redefining the category, with a focus on creating a great customer experience both through convenient drive-thrus and upbeat and friendly employee interactions with customers. Serving innovative and in-demand menu options like protein coffee, or ‘proffee’ as regulars sometimes call it, helps them acquire a new cohort of loyal customers.

— Kadecia Ber, Yelp's advertising trends expert and director of enterprise solutions

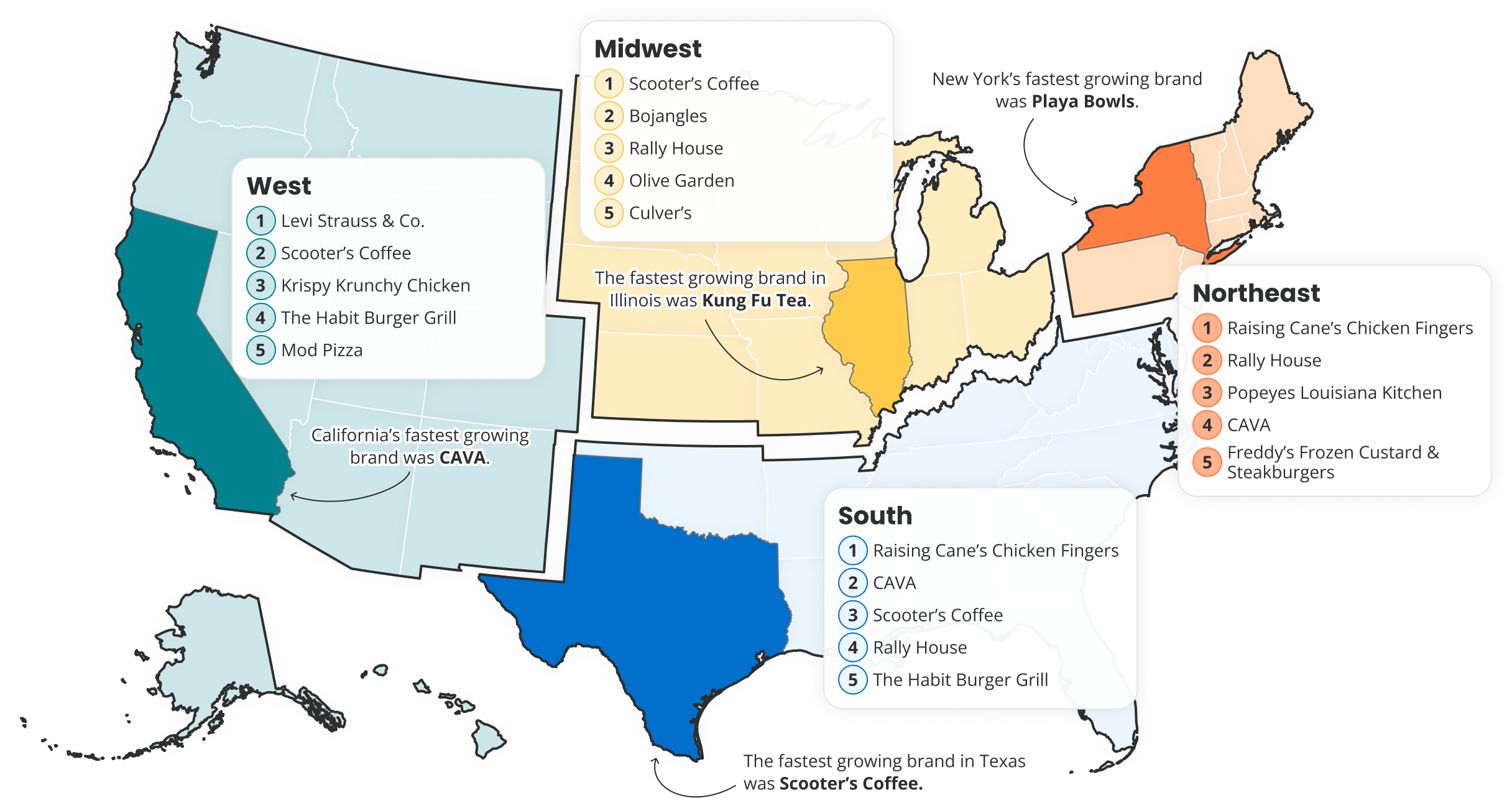

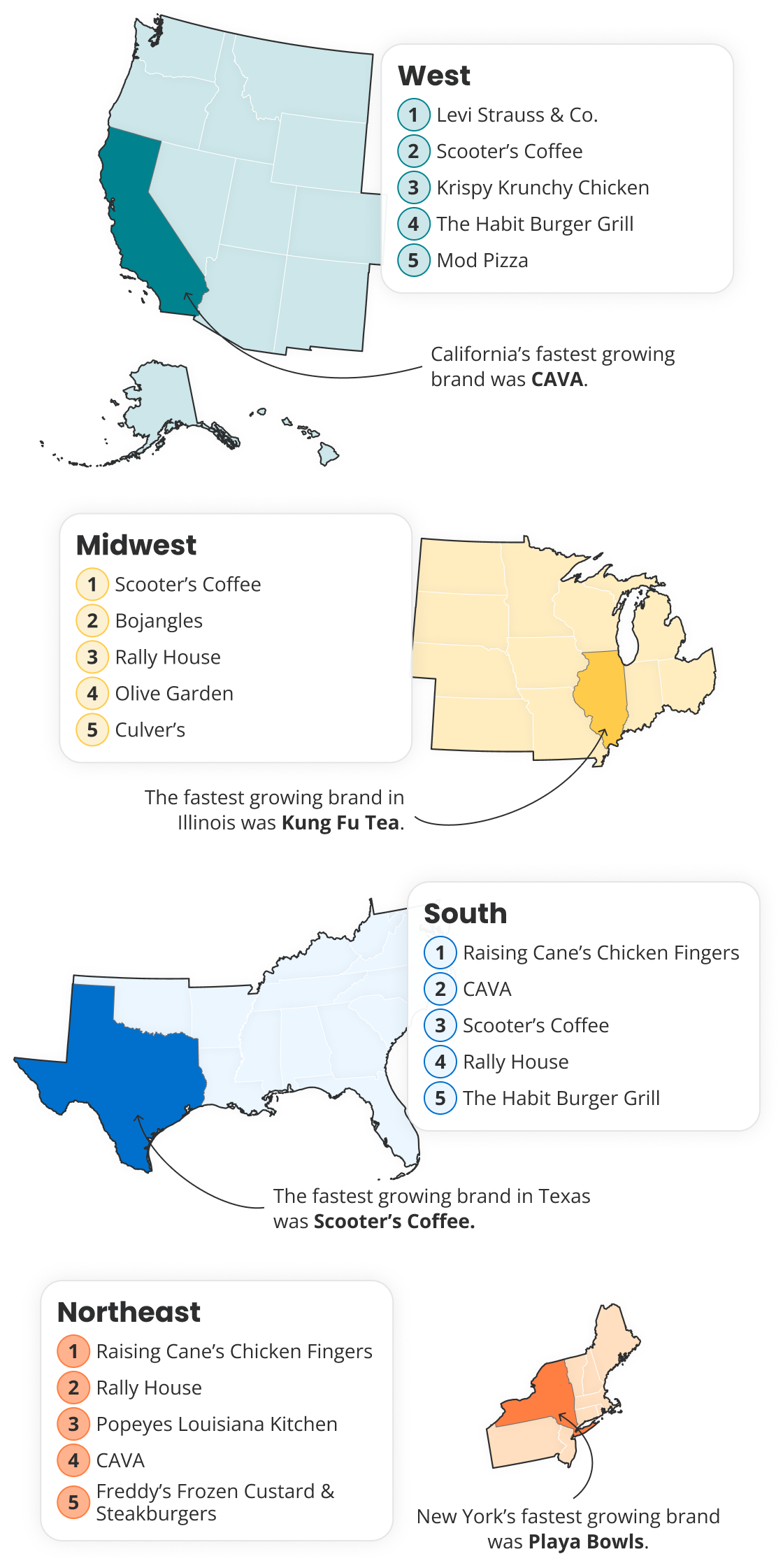

Mapping business growth by region and state

To better understand the kinds of businesses driving growth in different regions of the country, we crunched Yelp data to rank the top 50 fastest growing U.S. businesses by region and state. Looking regionally, the Midwest and South are on a caffeine kick, with several major brands known for their coffee and tea, including Nebraska-based, drive-thru coffeehouse Scooter’s Coffee (no. 2), East Coast convenience staple Wawa (no. 5), Caribou Coffee and boba tea favorite Kung Fu Tea (no. 45). Scooter’s Coffee saw a 53% jump in net new locations, the largest percentage growth of any food brand on the list. The coffee spot was also the fastest growing brand in the Midwest, with a 50% increase in consumer interest in the region. Wawa saw its grab-and-go food offerings resonate, with consumer interest nationally up 88%. According to Yelp data, the chain saw its fastest growth in Virginia, Florida and New Jersey, where consumer interest surged 137%. Kung Fu Tea was the fastest growing brand in Illinois, where it saw a 274% spike in consumer interest.

Meanwhile the coasts are the most health-conscious, with brands like Playa Bowls (no. 44) and CAVA topping New York and California’s fastest growing brands list, respectively. Consumer interest for Playa Bowls, which serves acai bowls and juices, soared 111% in the Big Apple, while consumer interest for CAVA in the Golden State climbed 79%.

Challenger brands Scooter's Coffee and Raising Cane's dominate regional growth

Retailers stood out as one of the fastest growing categories on Yelp. Ace Hardware, known for its selection of home improvement products and co-op business model, placed among the top five fastest growing brands in 27 states. Costco (no. 43) and Nordstrom are within the top five fastest growing brands in seven states each. Costco, known for its buy-in-bulk offerings and affordable food court, was the fastest growing brand in Delaware and North Dakota, with consumer interest increasing 44% and 70%, respectively. Nordstrom led the list in Washington, with 101% consumer interest growth, and Kansas, where it saw net new locations climb 42%.

Restaurants also charted on the states lists, as Popeye’s appeared in the top five in 19 states, Scooter’s Coffee in 18 states and CAVA in 12 states.

Ace Hardware and Popeyes lead growth in states

If you’re interested in learning more about brands on Yelp, visit Yelp for Brands.

- Nolan Russell contributed to this report.

Methodology

Fastest Growing Brands national ranking

To identify the Fastest Growing Brands, our data science team ranked brands using a blended metric including net new business openings, consumer interest, and searches on Yelp from 2022-2023. These metrics were then weighted.

The main metrics that define a Fastest Growing Brand on Yelp:

Net new business openings

Yelp measures net new business openings by considering new business openings and net closures in relation to the total number of locations for 2022-2023. New business openings refer to new business listings on Yelp in a given timeframe. The business listings are added by either business representatives or Yelp users. Business closures are permanent closures of locations as noted by Yelp users. This does not include temporary closures for holidays or other reasons.

Consumer interest

Yelp measures consumer interest by looking at select actions users take in connection with businesses on Yelp, including viewing business pages or posting photos or reviews. For this report, we measured consumer interest in 2022-2023.

Searches

Yelp measures the number of total searches for a brand from 2022-2023, as well as the brand’s share of category searches. Searches are based on consumer search queries where a given brand was a suggested result.

Downloadable static graphics can be found here.